schedule

2015 : Electronic invoicing in Argentina is mandatory for all companies operating there. This includes export invoices, incoming payments, credit notes and debit notes. Companies registered in the country must register with the national tax authority. Electronic Authorization Code (CAE) apply and comply with the specified requirements.

June 2021: All companies must have electronic invoices with QR codes.

applicability

The e-invoice primarily covers Business-to-Business (B2B) and Business-to-Government (B2G) transactions.

format

There are no fixed format. Invoices will be issued in the format agreed with the customer, but must be in XML format transmitted to the AFIP via WebServices.

Electronic signature

An electronic or digital signature for electronic invoicing is not mandatoryHowever, a digital certificate must be present.

Archiving

Both the sender and the recipient are obliged to pay the invoices 10 years long to keep.

How e-invoicing works

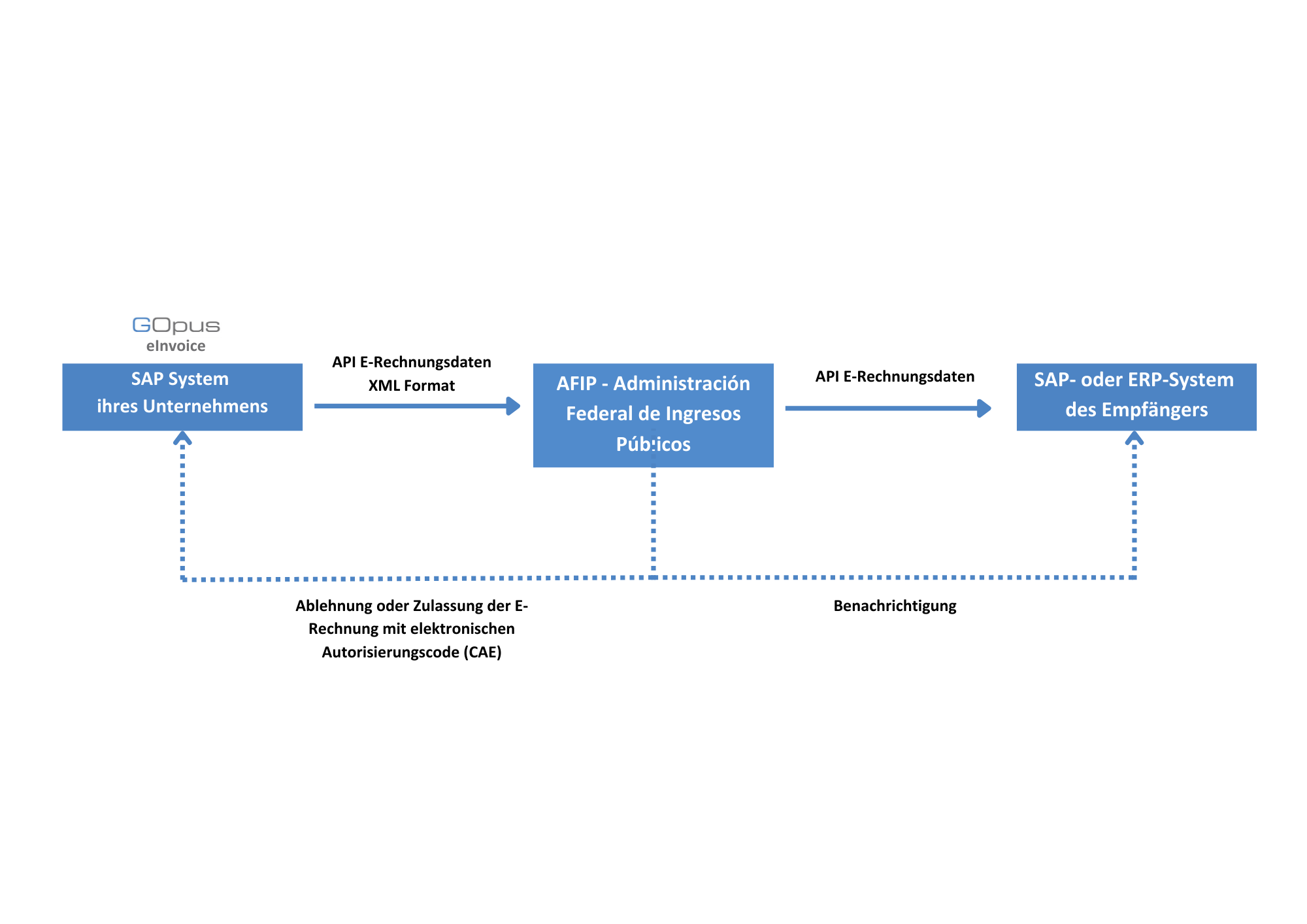

The process of Creation, validation, approval, transmission and storage of electronic invoices in accordance with the requirements of the AFIP (Administración Federal de Ingresos Públicos) includes several steps:

- First, the necessary Data from the supplier’s ERP system (SAP ERP/ S/4HANA & GOpus® eInvoice) and converted into the format required by the customer according to the rules established by the AFIP converted. Data validation mechanisms are used to ensure that all required information is correct and complete.

- After validation of the data, a connection is established to the AFIP to Electronic Authorization Code (CAE) required for the legal issuance of an invoice. The AFIP awards this CAE when the issuance of an invoice has been approved.

- The electronically signed invoice is then sent to the recipient via secure communication protocols. At the same time, the invoice is XML format transmitted to AFIP via a web serviceto document their reception and recognition.

- Finally, the invoices are signed by both the issuer and the recipient archived electronically. The invoices are issued for a statutory period of 10 years while ensuring the security and accessibility of the data during this period.

Further information

https://www.afip.gob.ar/landing/default.asp

GOpus® eInvoice

Our GOpus® eInvoice The solution can be integrated into SAP ERP and SAP S/4HANA and supports the creation of outgoing e-invoices in all international country formats. In this way, all your invoice contents can be created and sent between different international invoice issuers and recipients directly from your SAP system and all invoice documents can be archived in comprehensive monitoring. Integration into the SAP modules SD, FI, IS-H, IS-U and SAP Service Invoicing is possible. Further integrations are available on request.

Do you have further questions about our solution or would you like to obtain more detailed information about the e-invoicing regulations in Argentina?

We will be happy to personally assist you with any further questions you may have about our solution and the regulations.