schedule

2005: Brazil passes the first electronic invoicing law and introduces a clearing model.

2008: Taxpayers must issue electronic invoices starting this year.

April 2023: Electronic invoices for the energy sector (NF3-e) are introduced and gradually become mandatory.

September 2023: Even micro-entrepreneurs (MEI) who are not subject to the ICMS must issue electronic invoices

applicability

The e-invoice primarily covers Business to Business (B2B) and Business-to-Government (B2G) transactions.

format

Brazil uses different electronic invoice formats, all on XML-Data based, depending on the type of goods or services:

NF-e: For goods

NFS-e: For services

CT-e: For transportation

MDF-e: For freight

NF3-e: For power supply

Electronic signature

An electronic or digital signature for electronic invoicing in XMLDsig format is mandatory.

Archiving

E-invoices must 5 years long be stored.

How e-invoicing works in Brazil

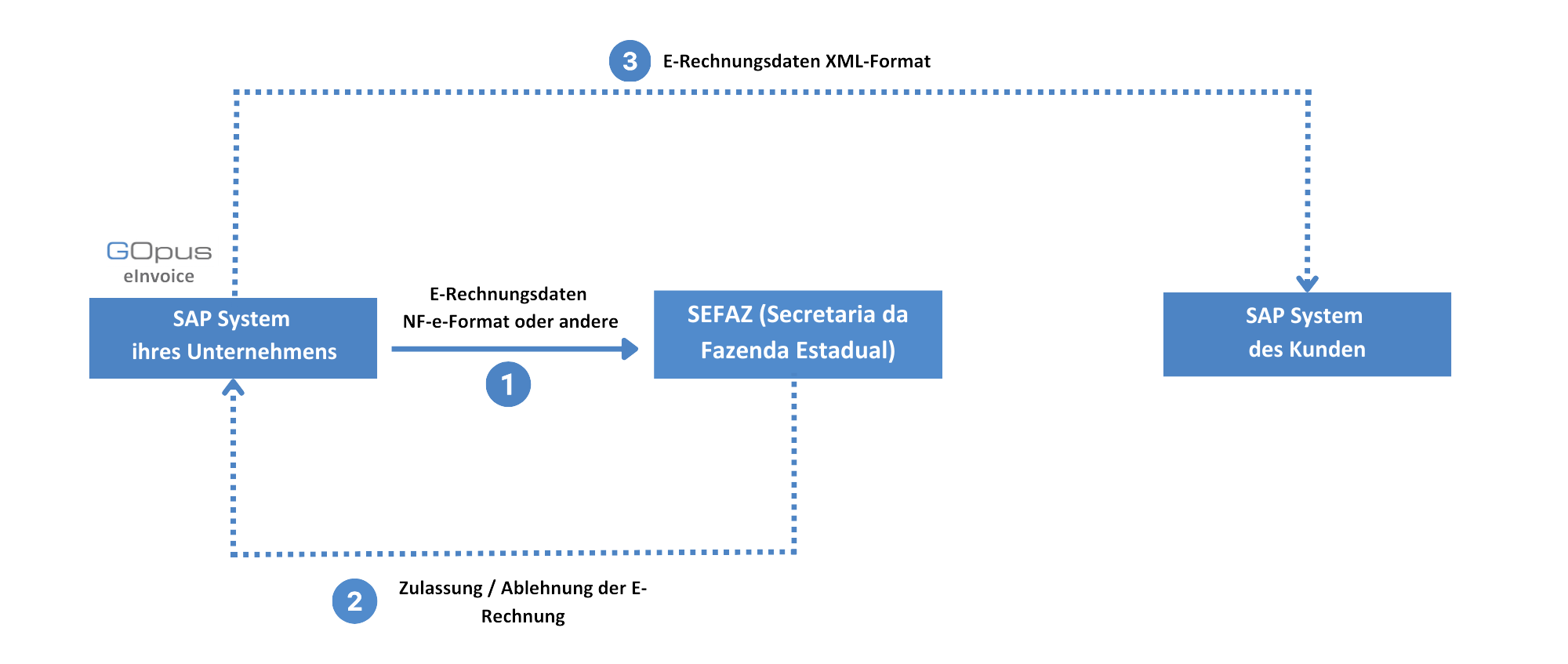

1. Generation: GOpus® eInvoice automates the creation of invoices based on SAP data by converting them into the standard format required by the Brazilian tax authority SEFAZ.

2. Communication: Connectivity is provided through a SEFAZ web service that allows secure and direct transmission of NF-e to SEFAZ and management of related events. This web service is also used for registration of the Recibo Provisional de Serviços (RPS) file and reception of NF-e authorized by the Authority.

3. Validation: SEFAZ carries out the audits and controls required by the Brazilian tax authorities. The entire process, from the creation to the validation of the invoice, is fully automated. Users can GOpus® eInvoice monitor the current status of their NF-e and are automatically informed of status changes or cancellations.

4. Integration: Once the invoice has been validated and approved by SEFAZ, GOpus® eInvoice various secure transmission methods to the customer.

More information about e-invoicing in Brazil

https://www.nfe.fazenda.gov.br/portal/principal.aspx

GOpus® eInvoice

Our GOpus® eInvoice The solution can be integrated into SAP ERP and SAP S/4HANA and supports the creation of outgoing e-invoices in all international country formats. In this way, all your invoice contents can be created and sent between different international invoice issuers and recipients directly from your SAP system and all invoice documents can be archived in comprehensive monitoring. Integration into the SAP modules SD, FI, IS-H, IS-U and SAP Service Invoicing is possible. Further integrations are available on request.

Do you have further questions about our solution or would you like to obtain more detailed information about the e-invoicing regulations in Brazil?

We will be happy to personally assist you with any further questions you may have about our solution and the regulations.