schedule

2009: Statement on the issuance of electronic documents.

2014: A phased timetable for the introduction of electronic invoices, which includes certain companies and

public institutions are obliged to join this new system.

2022: Resolution No. NAC-DGERCGC22-00000024 of Ecuador shares the commitment for the last two million

natural persons and companies.

applicability

The e-invoice primarily covers Business to Business (B2B) transactions.

format

XML-Format.

Electronic signature

Electronic signatures are XMLDsig format mandatory. In addition, the e-invoices must be successfully validated by the SRI a assigned authorization code and a graphical representation called RIDE own.

Archiving

E-invoices must 7 years long be archived.

Further information on electronic invoicing in Ecuador:

How e-invoicing works in Ecuador

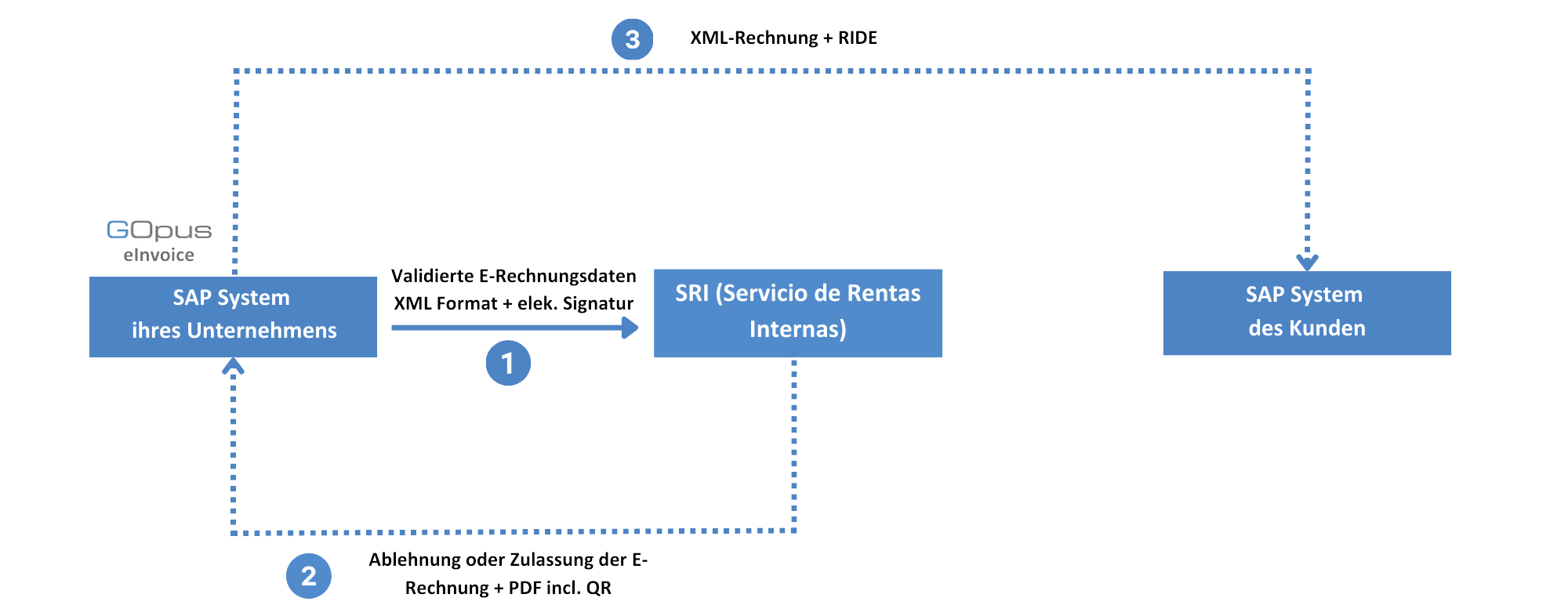

The process of electronic invoicing in Ecuador via SAP takes place in several steps:

First, a flat file is generated from the customer's SAP system, which contains all relevant information for the electronic transaction. We process this data and import it into the XML format (version 1.0) converted for electronic documents.

The second step is the validation and electronic signatureBefore the electronic invoices are sent to the Ecuadorian tax authority SRI and the recipients, the XML document is validated and then an electronic signature is added according to the XadES_BES standard, using a certificate issued by a qualified certification authority in Ecuador.

The signed XML document is then sent directly to the SRI via a secure connection. In the offline model, the SRI has up to 24 hours to process the electronic invoice. At the same time, a printable version of the CPE (Electronic Computing, in Ecuador as RIDE This print version and the XML document are sent to the recipient by email, via GOpus® eInvoice through which the status of the e-invoice can be tracked.

In the final step, the electronic documents validated and authorized by the SRI are automatically integrated into the SAP system. At the same time, both the electronic invoices and the SRI authorization data are stored in a single electronic file that serves as legal proof.

GOpus® eInvoice

Our GOpus® eInvoice The solution integrates with SAP ERP and SAP S/4HANA and supports the creation of outgoing e-invoices in all international country formats. This allows you to create and send all your invoice content between different international invoice issuers and recipients directly from your SAP system, and to archive all invoice documents with comprehensive monitoring. Integration with the SAP modules SD, FI, MM, RE/FX, IS-H, IS-U, and SAP Service Billing is possible. Further integrations are available upon request.

Do you have further questions about our solution or would you like to obtain more detailed information about the e-invoicing regulations in Ecuador?

We will be happy to personally assist you with any further questions you may have about our solution and the regulations.